Life Insurance Professional Development Programme

£150.00 + Applicable VAT

The LIPDP aims to deal with the regulatory requirements of IDD as well as providing an informative easy-to-use eLearning programme to develop the knowledge and effectiveness of employees at all levels.

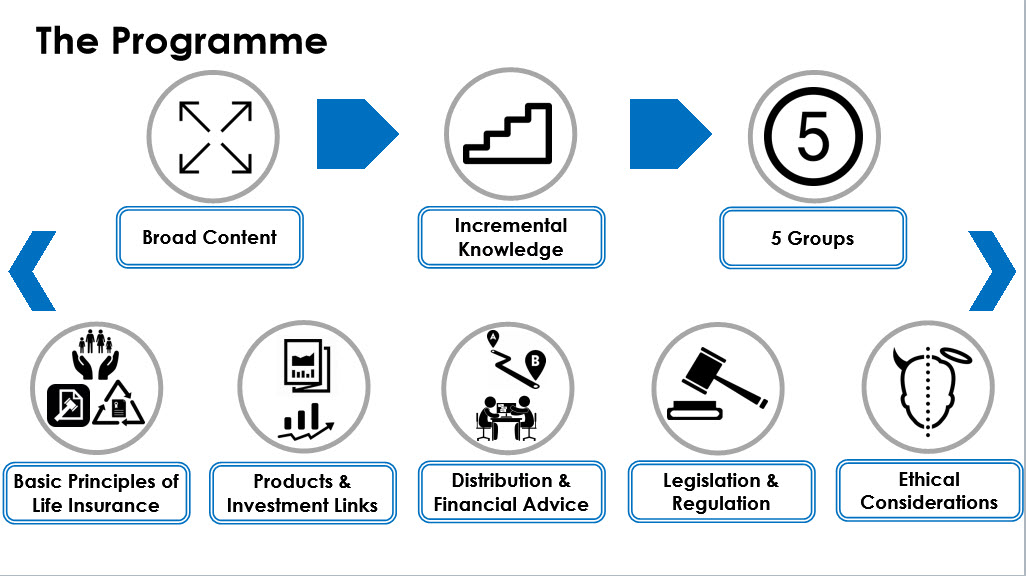

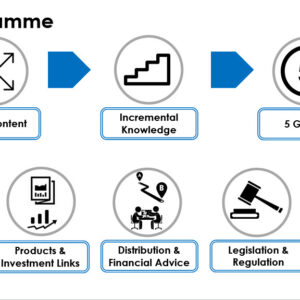

15 x 1 hour modules designed around the EU Insurance Distribution Directive (IDD).

Volume pricing available.

This course can also be deployed on your In-House LMS.

Product Description

A specifically designed elearning programme tailored to meet EU and UK regulations.

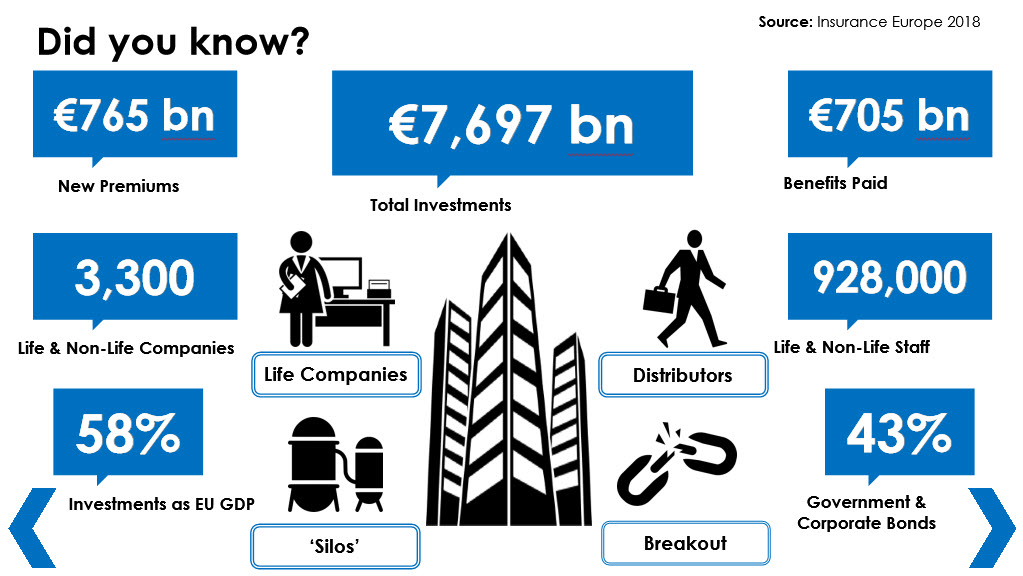

The Insurance Distribution Directive (IDD), and its replacement regulation in the UK, presents many new challenges for life companies. This includes the requirement to provide all customer-facing employees with a minimum of 15 hours of CPD training each year, covering a specified programme of content.

The Life Insurance Professional Development Programme (LIPDP) aims to deal with the regulatory requirements of IDD as well as providing an informative easy-to-use elearning programme to develop the knowledge and effectiveness of employees at all levels.

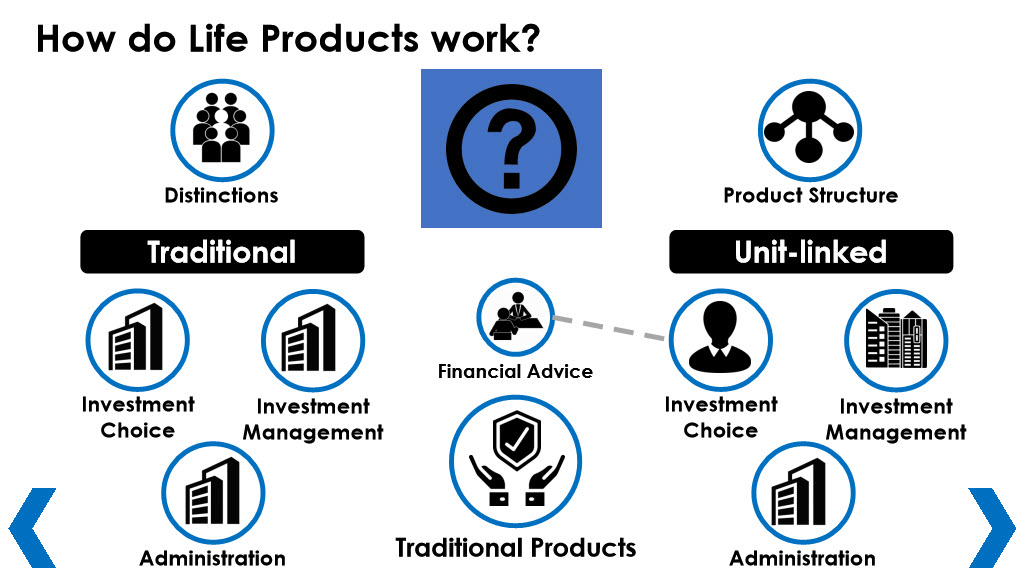

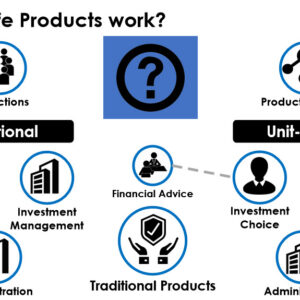

Our elearning programme has been designed by some of the most knowledgeable minds in the industry, to provide insurance professionals with an overview of all the component elements that make up the life insurance sector. The Life Insurance Professional Development Programme aims to inspire your employees by building their knowledge. Combining a sequential learning experience, covering the basic principles of life insurance with some of the more technical aspects of the business, in the same intuitive learning style.

15 Course Modules (1 hour each)

Introduction to the Life Insurance Professional Development Programme

i. Basic Principles of Life Insurance

01 Insurance Uncovered

02 Legal Principles of Life Insurance

03 The Lifecycle of a Policy

ii. Products and Investment Links

04 Protection and Savings Products

05 Investment Products

06 State, Workplace and Private Pensions

07 Investment Fund Options

iii. Distribution and Financial Advice

08 Distribution Options and Regulations

09 Financial and Investment Advice

10 Succession Planning

iv. Legislation and Regulation

11 EU Regulation and Consumer Protection

12 Solvency II and Risk Management

13 The Insurance Distribution Directive

14 Life Company Regulation & Asset Safeguarding

v. Business Ethics

15 Ethical Business

The aim of the elearning programme is to demystify the life insurance sector by delivering content in an accessible format that gradually reveals the ʻmysteries’ of the industry in a way that engages with its audience and lets them move through each module at a pace they can control. This programme takes the view that aspects of the life insurance industry may be complex, but it should be possible for everybody who works within the sector to be able to gain a firm grasp of how it all works. Easy to navigate and highly visual, each module can be started, paused and completed as and when participants want.

Attached to each module are helpful transcription notes and keyword references to provide a ʻroute map’ through the programme and to assist in the day-to-day role of participants. Finally, there’s a 15 question knowledge check at the end of each module which selects random questions from a bank to provide a formal test of subject understanding. When participants reach the 80% pass mark they will receive a certificate

and CPD accreditation of one hour per module.

Technical Details

- Our courses are designed to run in a desktop pc environment running the latest / updated versions of modern web browsers (Google Chrome, Mozilla Firefox, Microsoft Internet Explorer, Microsoft Edge).

- Audio must be enabled.

- The use of smartphones and tablets is not recommended as the screen size is small, but our courses will generally run on these devices.

Course Customisation (Optional)

We can customise this course for your organisation. Customisation can include:

- Branded elearning platform and course

- Branded certificates

- Additional or edited material covering your organisation and its AML policy and procedures

How to Order

Ordering from our site is very easy !

ONLINE ORDERS:

Simply add the required courses into your shopping cart and then proceed to the checkout. You can pay by bank transfer or by credit/debit card.

If you pay by bank transfer, we will send your course login instructions once we have received the funds on our account.

If you pay by credit/debit card, we will send your login details as soon as we have setup your account (during normal working hours Monday to Friday). Orders received on weekends and bank holidays will be processed on the next working day.

OFFLINE ORDERS:

If you prefer to order offline, you can do so as follows:

Send us an email to orders@governancepeople.com and include the following data:

- The name(s) of the course(s) that you wish to order.

- The First Name, Family Name and Email Address of the user(s) for each course.

We will then send you an invoice by email that will allow you to pay for your course by bank transfer or credit / debit card.

VOLUME PRICING:

We provide volume order pricing for clients that purchase more than 10 course licences. To enquire about volume pricing please email us.

ENTERPRISE LICENCES:

If you have a corporate Learning Management System (LMS) and would like to obtain an enterprise licence, please use the product enquiry form and we will be delighted to discuss your needs.

Product Enquiry

Related products

Financial Crime

Financial Crime